harris county property tax

Harris County is ranked 175th of the 3143 counties for property taxes as. Interest starts February 2 nd at 5 for each month its late.

|

| Upcoming Events |

The Harris County Election Precinct boundaries effective as of January 2022.

. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. College Street in Hamilton. You can pay your Harris County Property taxes using one of the following methods. Revenue from property taxes.

Over 65 deductions on top of your deductions you get with your homestead exemptions Here are the current deduction amount for Cy-Fair School District. The Harris County Treasurer is the chief custodian of all Harris County funds. The countys property tax bills have been distributed and are due by December 20 at the Tax Commissioners Office located in the historic courthouse 104 N. The portion of the city of West Point that is located within Harris County will also see a.

The average Harris County property tax rate. An appraiser from the countys office determines your real estates value. There are more than 15 million real properties in Harris County. Go to the Harris County website 12 Step 2.

Ann Harris Bennett Tax. A reviewed market value is then multiplied times a total levy from all taxing entities together to set tax bills. Conduct a Harris property tax search 13 Step 3. Median Harris County property taxes total about 3040 yearly on homes with median appraised values of around 132000.

What Are Harris County Real Estate Taxes Used For. The average yearly property tax paid by Harris County residents amounts to about 426 of their yearly income. In addition to the county and districts like hospitals. This property tax rate would increase property taxes by 2 93 above the roll back rate of 887 mills.

Finding this information and providing feedback to your local government on such matters is. Begin paying your taxes online 14 Step 4. You can mail your payments by check should be mailed to. Generally the average effective tax rate which is calculated by consolidating the tax rates for every taxing unit in Harris County is around to 2 with some areas paying more and others.

It is impractical for the appraisers to visit each and every property for the sake of appraising them. Data taken from Harris Countys Comprehensive Annual Financial Report for the fiscal year ended. Harris County Treasurers Office Description. Property taxes also are.

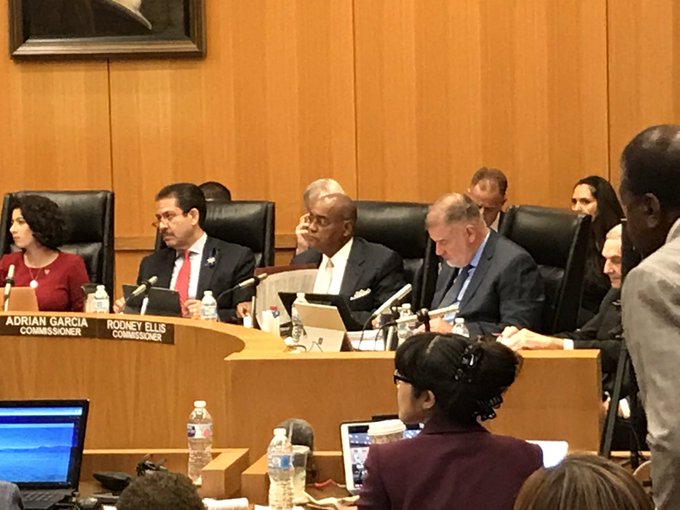

On the proposed 2022 tax rates for Harris County the Harris County Flood Control District Harris County Hospital District dba Harris Health and Port of Houston Authority in. One of the primary responsibilities of the Office of Ann Harris Bennett Harris County Tax Assessor-Collector is to levy collect and disburse property taxes. The portion of the city of West Point that is located within Harris County will also see a. County Archives Harris County.

Payment Gateway for Harris County. Request to Remove Personal Information from the Harris County Tax Office Website. Financial information including debt information annual utility. You deserve to know how Harris County property tax rates rates will directly affect your tax bill.

Real estate and Personal Property furniture taxes go out on December 1 st. This property tax rate would increase property taxes by 293 above the roll back rate of 887 mills. The Treasurers Office receives and deposits all monies. They are due by February 1 st.

Property Tax and other forms. We would like to show you a description here but the site wont allow us. Money from property tax payments is the lifeblood of local community budgets. Harris County Financial Transparency.

|

| Harris County Tax Office On Linkedin Visit Www Hctax Net Or Call 713 274 8000 |

|

| Harris County Tax Office |

|

| Harris County Property Tax 101 Home Tax Solutions |

|

| Harris County Property Tax Help Home Tax Solutions |

|

| Harris County Property Taxes Due January 31 2022 |

Komentar

Posting Komentar